Accounting data refers to the financial information collected by a company to support its financial statements, serving various purposes such as evaluating company performance, ensuring regulatory compliance, and providing a neutral foundation for corporate strategy development. Recent advancements, especially the introduction of advanced data analytics in accounting, have brought significant innovation to this field. By employing algorithms to analyze extensive datasets, managers and stakeholders can uncover insights that may not be readily apparent. Even small companies possess a vast amount of accounting data, which, when effectively utilized, can be a powerful asset. Understanding how financial data is used in making business decisions can help improve company performance.

What insights can be derived from your business’s data?

Chances are, your business already utilizes various technologies that gather substantial amounts of data on its operations. This collected data, once combined and analyzed, represents a valuable source of knowledge.

Here are some ways in which your business can benefit from its accounting data:

- Enhancing decision-making processes and facilitating decision-making.

- Streamlining strategic planning procedures.

- Identifying areas of difficulty and potential revenue-generating opportunities.

- Staying ahead of competitors.

However, it is essential to exercise caution and avoid getting overwhelmed by excessive data. While data collection is beneficial, becoming overly enthusiastic and curious can dilute your focus.

Business Planning:

Accounting data is commonly employed in creating budgets and forecasts for business planning. Many organizations rely on the budgeting process as an integral part of their annual planning. Accounting data from previous years is often used as a starting point to estimate sales and expenditure levels for the upcoming year. This involves projecting sales, cash collections, purchases, and expenses, and creating anticipated financial statements based on historical accounting information.

Investment Decisions:

When a company has surplus cash, accounting data helps management determine how to invest those funds. By assessing financial forecasts, management can ascertain the amount of cash required in the near and long term. This information aids in deciding whether stocks, bonds, or other investments are suitable for storing funds for the desired duration. Additionally, accounting data is used to evaluate the financial records and prospectus reports of potential investments.

Benchmarking:

Apart from comparing financial performance to organizational budgets, accounting data is also utilized in benchmarking. This involves comparing a company’s economic data to industry or other company financial information to assess performance relative to peers. While benchmarking can be helpful, small business owners should exercise caution and choose the most appropriate comparison group, as large publicly listed organizations may not always be the ideal reference.

Business Evaluation:

Accounting information is not only used to analyze past business performance but also to forecast future performance. Small business owners often compare actual sales, spending, and profit with expected performance on a monthly basis. Significant discrepancies between expected and actual performance prompt adjustments to the company’s structure, enabling management to address minor concerns before they escalate.

Marketing:

Marketing and advertising are crucial for attracting customers and increasing awareness of your business. Accounting services data reveals the budget allocated to marketing and advertising efforts and provides insights into the revenue generated from those investments. By analyzing the cost and impact of marketing campaigns, businesses can redirect their efforts or adjust strategies accordingly.

Lenders:

Access to finance is vital for business establishment and growth. Typically, businesses rely on lenders or investors for funding. Financial forecasts based on accounting data help entrepreneurs demonstrate the attractiveness and potential returns on investing in their businesses, particularly for startups.

Corporate Responsibility:

Reliable accounting practices ensure compliance with legal and regulatory requirements for both internal business operations and external stakeholders such as investors and lenders.

Increased Profit Margins:

By employing data analytics in accounting, companies can identify customer behavioural patterns, enabling the creation of analytical models to discover investment opportunities and improve profit margins. Accounting data analytics contributes significantly to achieving higher profitability.

Cash Flow Analysis:

Accounting data analytics plays a crucial role in managing cash flow effectively, identifying areas for cost reduction, and making smarter investment decisions.

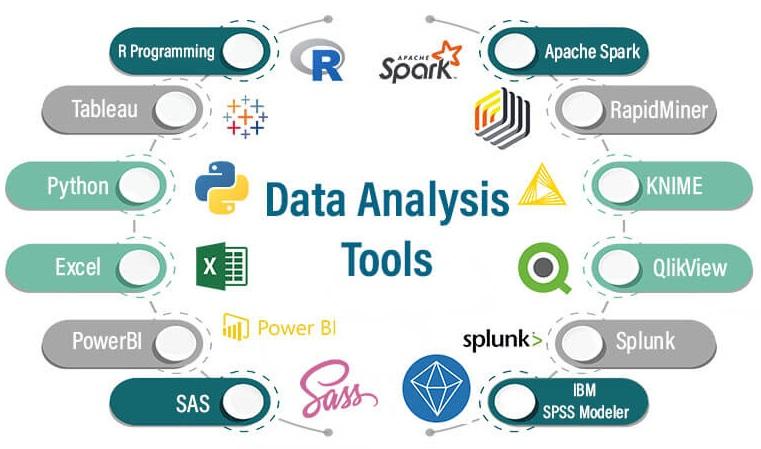

Tools Used in Accounting Data Analytics:

R and Python:

Sophisticated accounting data analytics tools such as R and Python are widely employed. These programming languages enable advanced statistical analyses tailored to specific requirements.

Proprietary Tools:

Large businesses often develop and use proprietary tools exclusively to produce and market their goods and services. These tools are continuously evolving to meet changing demands.

Major Challenges in Using Data Analytics in Accounting:

Inaccurate Data:

Manual data entry is a common source of inaccurate data. Investing in a centralized system with validation checks can help resolve this issue.

Lack of Support:

Organizational support is crucial for successful accounting data analytics. Each employee’s contribution to the data collection process is essential, and failure to provide the required data can hinder the generation of useful insights.

Lack of Expertise:

Many businesses face challenges in data analysis due to a lack of analytical expertise among employees. Emphasizing analytical skills during the hiring process can help mitigate this issue.

Conclusion:

Informed decisions based on actual facts and data are wise and reliable. Accounting reports provide a summary of a company’s cash flow, and their influence extends beyond internal operations to external stakeholders, including potential investors who evaluate a company’s financial service reports to assess its performance before making investment decisions.