The Income Tax Act of 1961 offers taxpayers a precious aid referred to as the Income Tax Updated Return (ITR-U). This unique form, special below segment 139(8A), serves diverse capabilities and offers people the threat to deal with special factors of their income tax responsibilities. Let’s delve into the complexities of ITR-U, analyzing the way it empowers taxpayers to correct errors, revise earnings declarations, adjust the income category, decrease deliver-forward losses and unabsorbed depreciation, manage income tax credit, and more.

To explain the idea of revised income tax as a part of the method of submitting ITR-U online:

The Income Tax Return (ITR-U) is a distinct form designed for taxpayers under Section 139(8A) of the Income Tax Act. Unlike regular tax returns, which must be filed on time, ITR-U caters to individuals who previously failed to file their tax returns. This form enables them to meet their obligations and rectify their tax submissions.

A key advantage of ITR-U is its ability to rectify errors or omissions in prior tax filings. It empowers taxpayers to make necessary corrections, ensuring accurate disclosure of income and related details. This contributes to transparent tax records and adherence to tax regulations.

ITR-U also offers flexibility in categorizing income correctly, preventing potential inconsistencies. This addresses issues related to income classification and allows proper allocation under the appropriate head.

Furthermore, ITR-U facilitates the provision of carrying forward losses from previous years, optimizing the extent of loss carryforwards in line with current financial circumstances. This equilibrium helps taxpayers utilize losses effectively while meeting tax obligations.

Likewise, accumulated unabsorbed depreciation can influence tax liability. ITR-U provides a means to deduct this amount, aligning depreciation calculations with current financial situations for an accurate representation of income and tax liability.

Apart from the mentioned benefits, ITR-U permits taxpayers to amend their tax returns according to current financial conditions, minimizing potential conflicts and ensuring accuracy. Comprehending the deadlines established by tax authorities is vital for the timely submission of updated tax returns.

Understanding the final date for submitting revised earnings tax returns for filing of ITR-U:

The cut-off date for submitting a brand new earnings tax go-back relies upon the assessment year and is commonly 24 months from the give up of the unique assessment 12 months. Simply placed, taxpayers have time to file an updated return, permitting them to accurate mistakes or omissions in previously filed returns.

The time body for submitting ITR-U:

To illustrate this idea, let us not forget the evaluation for 12 months 2022-23. In this case, people have till March 31, 2025, to report updated returns. This closing date permits taxpayers more time to accumulate important information, make corrections, and ensure their online income tax returns appropriately replicate their earnings and relevant statistics

Don’t forget and work on time:

It is satisfactory to hold a structured method, the use of available sources together with online equipment and statistics from tax authorities to get facts and meet cut-off dates speedy.

Eligibility for submitting ITR-U:

Anyone who has made errors or neglected to claim income inside the following kinds of files is eligible to record ITR-U:

- The primary source of earnings

- A delayed return goes to

- Updated Regression

Related ITR-U report statistics:

There are diverse instances in which a character can choose to record an amended return with the use of ITR-U. These conditions consist of:

- Missing closing date for submitting a return: If the taxpayer fails to submit the authentic return within the stipulated time and additionally misses the deadline for subsequent returns, ITR-1. U has filed an up-to-date tax go-back to fulfil its tax liability.

- Incorrect Income Declaration: In instances where earnings aren’t as they should be declared within the authentic, next, or adjusted form, submitting extra income through ITR-U permits the person to rectify this discrepancy and ensures the right disclosure of profits.

- Wrong Head of Income: If the taxpayer realizes that he has wrongly categorised his profits beneath the wrong head, ITR-U allows correcting this mistake and distributing the income to an appropriate officer, thereby ensuring that the tax is successfully calculated.

- Incorrect tax fee: Individuals who pay tax incorrectly on their original, later, or amended returns can use the ITR-U to adjust the tax charge, though meet suitable taxes and save you feasible tax evasion.

- Reduction in losses carried forward: ITR-U enables taxpayers to lessen losses carried forward from previous years. These changes help individuals better meet their tax responsibilities and maintain a balanced technique beyond losses.

- Reduce unrecognized depreciation: Unlike loss carryforwards, unrecognized depreciation will have a tax effect. By filing an ITR-U, individuals can limit unused deficiencies by ensuring that their income and associated taxes are appropriately suggested.

- For functions of reduction of tax u.S.115JB/115JC: In certain cases wherein a taxpayer has claimed overpayment of tax under Section 115JB or 115JC, ITR-U lets in adjustment to lessen tax rate for ensuring that they agree to tax legal guidelines.

- Restrictions on submitting ITR-U: It is vital to word that a taxpayer can document the best updated return in every evaluation year (AY). Therefore, people should cautiously evaluate their popularity and make certain that any essential corrections or adjustments were efficaciously made in a single up-to-date return.

While filing an Updated Income Tax Return in Delhi It is vital to note that depending on the timing of submitting, you could have to pay extra tax in case you document an ITR-U after three hundred and sixty-five days from the year situation to the top of the relevant evaluation (AY) a ) or inside 24 months from the give up of the relevant AY, payment is due. The surtax might be both 25% or 50% of the additional tax calculated with relevant interest.

How to report Form ITR-U: Summary

To record the ITR-U form, taxpayers are required to grant unique statistics and those steps need to be followed.

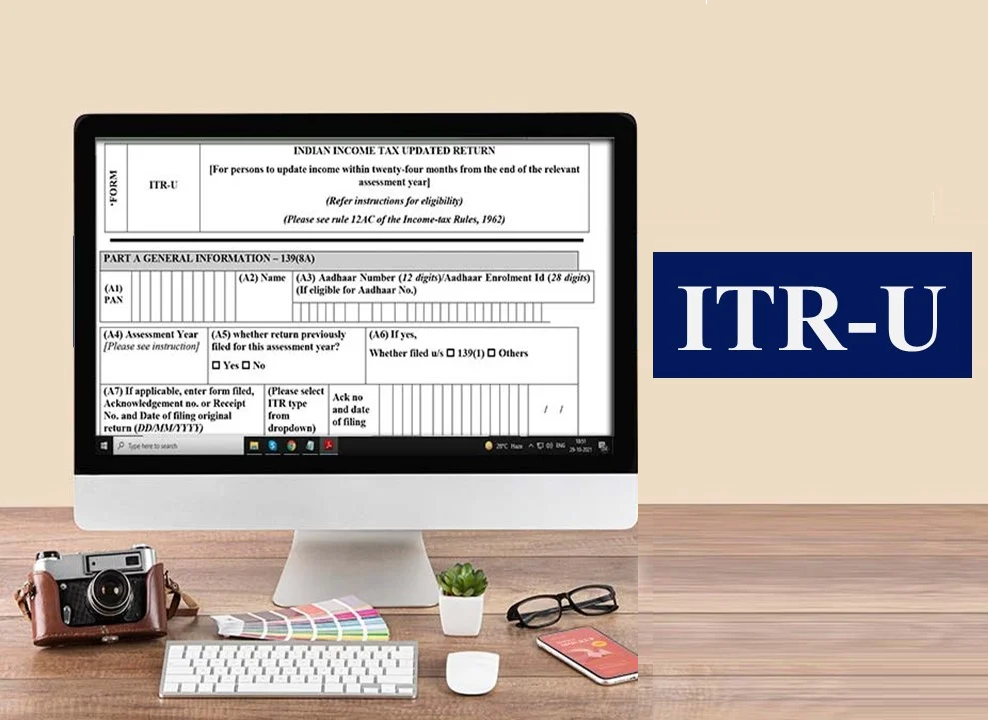

Part A – General records:

- Provide PAN, Aadhaar wide variety and 12 months of assessment.

- Indicate whether returns have been formerly filed on this evaluation 12 months and under which category.

- Select the ITR shape and report an updated go-back.

- Indicate the cause for updating the income, including a profits announcement that had not already been filed or an incorrect income statement.

- Ensure that the updated return is submitted now not later than three hundred and sixty-five days from the stop of the relevant AY or among 12 to 24 months from the quit of the applicable AY.

- Emphasize that the modified refund may additionally lessen losses carried ahead, unrealized depreciation, or tax credit.

Summary of Part B sections.

- Identify the title of profits said in different income.

- Provide gross earnings in line with final prison interest, if relevant.

- Calculate gross profits via Part B-TI and decide the amount due or refundable.

- Consider the quantity due or refund based totally on the final criminal return, if applicable.

- Indicate the total quantity of refund required and rebate in step with the final relevant rebate.

- Accounting for default charges for failure to record a go-back of income.

- Apply ordinary invoice tax, if relevant.

- Calculate all overdraft legal responsibility.

- Determine the additional tax legal responsibility on these days’s earnings, 25% or 50% of the distinction between nine and seven respectively.

- Calculate the amount due (9 -10).

- Provide info on tax paid beneath phase 140B.

- Calculate tax legal responsibility (11 – 12).

- Provide information on tax payable inside the draft and go back underneath Section 140B.

- Include statistics on enhanced taxes, personal taxes, or everyday taxes not listed in the preceding return.

- Note that credit for the above fee is no longer allowed under section 140B(2).

- Include any remedy underneath section 89 that had now not been claimed within the go-back, considering that relief can not be claimed beneath phase 140B(2).

By following those steps of online Income Tax Returns and offering the required statistics as they should be, taxpayers can file Form ITR-U effectively.